I’ve spoken hundreds technology solution provider executives in past few years and they’ve all described their company’s growth experience as exhilarating, exhausting, occasionally terrifying, but mostly unbelievably rewarding.

One experience they all shared, was that as their company’s grew and they become less involved in daily activities like quoting, service delivery and invoicing, they began to rely more heavily on reports and business analytics to stay on top of their businesses and make informed growth decisions.

The key question they all had was:

“Am I measuring and reporting on the right things (Key Performance Indicators) now that my company is larger, as opposed to the things I used to measure and report on when the company was smaller?”

The truth is, many companies outgrow the metrics and Key Performance Indicators that used to measure the health and well being of their business.

This is where best practices regarding “What should I be measuring and reporting on” start to come into play. Click here to see the Promys Executive Reporting Video

5 Ways Growth Changes Executive Reporting Needs

1) Measuring Margin vs. Revenue

In the early stages of a business, growing top line revenue is one of the key success metrics. Growing the number of customers, increasing the number of deals and deal size is the key scoreboard measure for whether the business is successful. Landing that big spotlight customer, increasing the overall number of customers, or establishing an ‘ability to close’ reputation with key suppliers is often more important than margin % on particular deals.

Margin funds Growth, not Revenue

As the business grows many executives begin to realize that profitability funds future growth, not just more revenue. For example, increasing Sales by 50% (from $4 Million to $6 Million) with a corresponding doubling of costs ($2 Million to $4 Million), may actually yield the same ($2 Million), or less gross profit dollars. That means no additional funds to invest in hiring new employees, expanding office space, or investing in marketing.

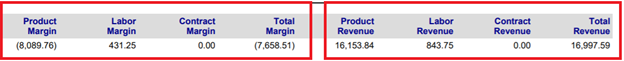

At this point the business focus turns to “how do I increase margin and profitability”, vs. just growing revenue. Determining your most (and least) profitable Customer, Line of Business, Service or Product becomes critical for making future growth investment decisions.

2) Proactive vs. Reactive Visibility

When a company is small and nimble and senior executives still have their hands on a lot of the daily operational transactions (Quoting, Service Delivery, Invoicing, etc.,) they still have a gut feel for how sales pipelines, project delivery and customer support are progressing. As long as the quarterly P&L numbers are in the green, then that’s all the reporting they need to tell them things are going well.

BUT, once the company get’s bigger and Projects grow in number and in size, finding out for example that a large multi-million dollar Project or Support Agreement has lost money after it’s completed, is a very expensive way to engage in continuous improvement.

What a company in that growth stage really needs is Reporting information that provides:

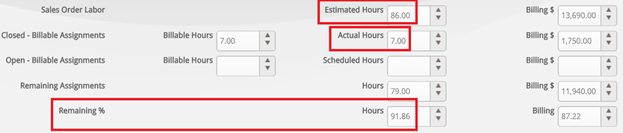

a) Real-time Visibility into Actual Costs vs. Original Estimate performance

b) Ability to Cycle Implementation Lessons Learned back into the Quoting process

If you agree with Point #1, that Profitability is a key metric to monitor, then the next step is to monitor how profitability is trending in real-time (so that we can influence it) vs. finding out after the fact when it’s too late to do anything about it.

Manually collecting revenue and cost data that tracks quoted Project estimates to Project actuals, or Support or Managed Service Contract profitability, can at best be done on a periodic basis, or worse yet at the end of the Project or Contract.

That’s too late.

To manage risk and grow in a controlled manner, you need to know in real-time, that a Project or Contract is “trending” towards unprofitability, not once it’s actually unprofitable, so that you can intervene and hopefully influence the outcome.

The other aspect is, you only want to make quoting or implementation mistakes once, not repeat the same mistakes again and again. So you need reporting that compares what your team thought was going to happen, compare it to what actually happened and cycle those lessons learned back into the quoting process.

3) Setting Targets

A very interesting statistic and “best practice” around targets, is that companies that set targets and provided regular updates to employees and department managers about how the company was performing against those targets, outperformed companies that did not set targets by an average 15% – 20%, independent of what the growth targets actually were.

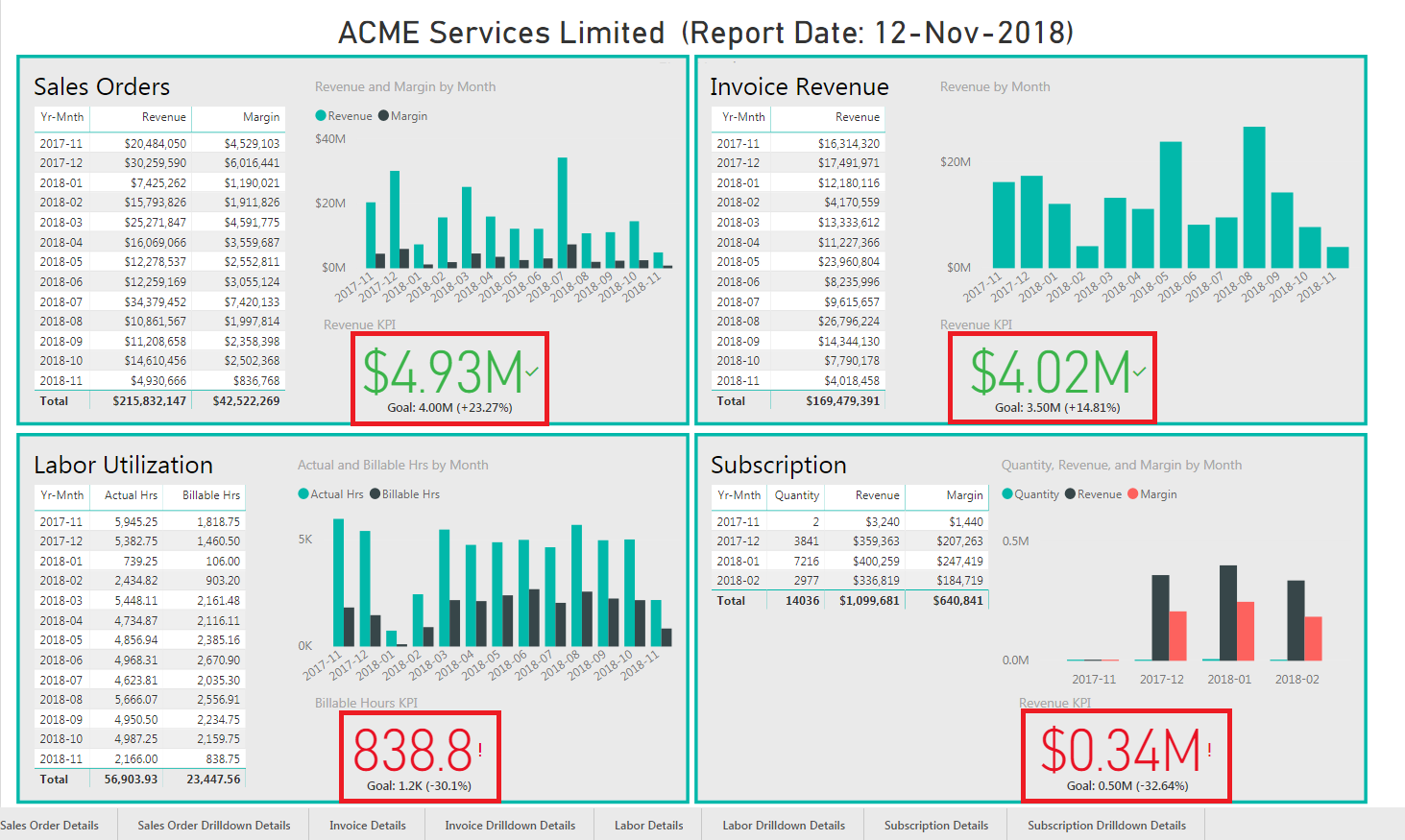

Showing actual business performance against the targets in terms of what’s in the green, yellow or red vs. the target and organized into meaningful reporting buckets (bookings, invoice/cash flow, labor utilization, subscriptions/managed services, etc.,) provides executives with ‘at a glance’ indicators as to whether the business is on track or not in key areas.

For the areas in the red, providing one or two click drill down capability to get to the underlying “how come” details, would be the other capability to make the target analytics useful. Setting targets and providing employees with regular feedback against those targets is very important aspect managing growth effectively.

4) Comparative Analytics

In their early stages companies may only offer one product line and service type at one rate that they provide out of one location. This makes it relatively easy to track how things are progressing. You’re either generating more or less Product and Services business for that one location.

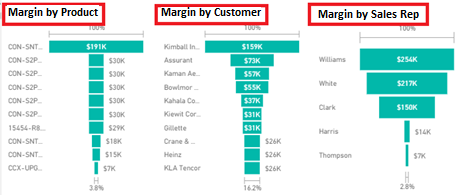

But as the company grows it’s very common to start offering several different service or product types (Hardware, Software, Subscriptions, Managed Services, Monitoring, Consulting) out of multiple locations. At this point, comparative analytics start to have significant value.

Who is our most (and least) profitable customer? What did we sell them that made them our most profitable customer? What is our most profitable Line of Business. What is our most profitable Professional Services type? Which customer consumes the most Managed Services, which one consumes the least? What lessons can we learn from this and cycle back into the business?

Combine that with the ability to “drill down” and/or with month over month trending and you start to provide the executive team with some very valuable analytics into which areas of the business they should keep investing in, and where it might makes sense to redeploy resources to more profitable areas.

5) Automatic report generation – Make it simple

In the early days of growth, if the CEO wants to know what’s going on in Sales or Finance, they just called the Sales or Finance Manager into their office and ask for a debrief. As the company grows, managing competing executive appointments and preparing the volume of reporting data required to have a meaningful discusson often makes that approach impractical going forward.

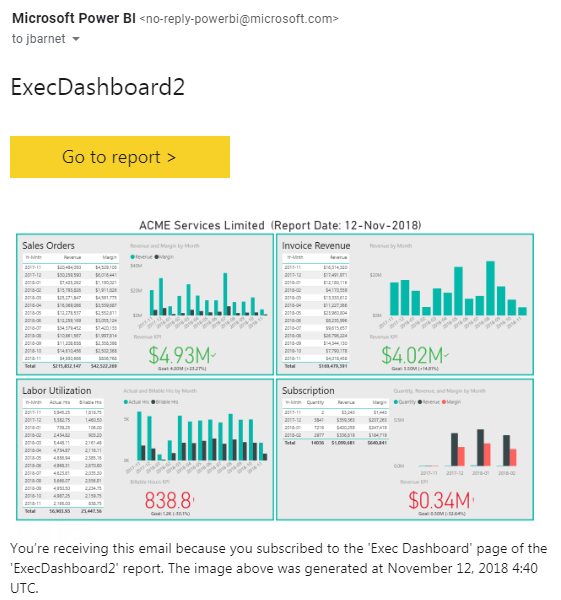

Very few senior executives have the time or inclination to log into their business software, fill in a bunch of report criteria fields and then run their reports. What they really want are the relevant reports delivered to them at 8:30 am every Monday morning (or whatever their schedule dictates) and they don’t want to have to learn any new software to access the reports or drill down a level or two for details.

So the best way to provide senior executives to receive the reporting information outlined above is to push it out to them via e-mail, with one or two clicks to access the report and drill down.

This approach is much more efficient and effective than spontaneous department manager calls ins, and the CEO or senior executive can schedule meetings with department managers and ask much more informed questions once they’ve reviewed the report data and drilled down for some of the details.

Summary

Based on the constraints of some of the legacy reporting approaches, it’s no wonder why so many technology solution providers are struggling to collect the data and provide the reporting & analytics that their executives need to make informed business decisions. The good news is, it doesn’t have to be this way. Check out the Promys Executive Reporting Video to help determine the best way to provide your company’s senior executives with the business reporting & analytics they need to make better business growth decisions.