Why should you spend time paying attention to Cash Flow (CF) vs. other priorities? CF is even more critical to a growing business. It’s an often-ignored opportunity to improve net profitability.

Why should you spend time paying attention to Cash Flow (CF) vs. other priorities? CF is even more critical to a growing business. It’s an often-ignored opportunity to improve net profitability.

CF is typically 4th on the list of KPIs (Key Performance Indicators) behind revenue, margin, and utilization. Accounting is seen as the sole owner of CF. We also assume suppliers (payables) and customers (receivables) control outcomes. Statistically, over 65% of growing businesses experience serious CF trouble despite great sales and even margins.

4 questions to determine if the following tips can help you.

- Do you invoice at month-end when a job was completed earlier?

- Do you ever ask for deposits?

- Do you sell annual or multi-year contracts with payment up front?

- Have you recently asked your top suppliers to extend credit terms?

If you answered no to any of these questions, then read on.

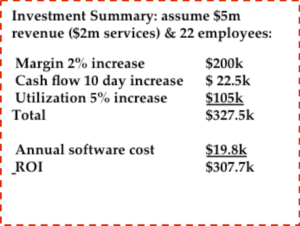

Tangible Benefits

- Reducing your line of credit by 20-30% can add 1-2% to net profit

- Pay suppliers early for a 2% discount directly impacting net margin

- Sets a tone for employees and customers of a well-run business

- With CF on hand equal to 3-6 times operating expenses a business suffering a 2-month drop in sales doesn’t panic

Invoicing Faster

Companies invoice at month end because they rely on technicians or Project Managers to pass emails or spreadsheets on the last day of the month to trigger billing. If a project is completed on the 15th, you have added a 15-day delay to the 30 or 40 days when a customer pays.

If accounting receives a daily flag for shipped equipment or completed work orders, you have removed one step in a process. It is much easier to invoice daily or weekly. While some customers may want end-of-month or milestone billing, those that do, don’t increase your CF. Businesses have found they can reduce their line of credit by $100,000, even up to $500,000, depending on their sales volume.

Extra Tip 1: Make it a practice of calling customers with a friendly reminder 3-5 days before payment is due. If customers are prioritizing payments, yours will get into the “pay this week” folder. Add a short-term incentive to the accounting team if they move the Days-Aged number by 5 days consistently over a 4-month period. It creates a new best practice for them.

Receiving Deposits

Do you have a policy where salespeople are encouraged to ask for deposits? While some customers may refuse or have a policy against paying in advance, the ones who can contribute to your CF. Deposits of 10% will generate $100,000 in positive CF for every $1m in sales.

Do you have a policy where salespeople are encouraged to ask for deposits? While some customers may refuse or have a policy against paying in advance, the ones who can contribute to your CF. Deposits of 10% will generate $100,000 in positive CF for every $1m in sales.

Extra Tip 2: Use this as a negotiating tool to close a sale by offering to waive or reduce the deposit rather than offering a price discount. Customers feel they are getting value without you giving up margin. Does your Project/Service software easily support and track deposits?

Extending Supplier Terms

Suppliers are the major source of product payables. When supplier sales spike or when you reach key customer status with them, it’s a good time to ask for extended payment terms.

Extra Tip 3: Receiving 15 or 30-day extended payment terms could mean your receivable is coming in before the payable is due. If you don’t ask, you’ll never know. Stop being your customer’s bank!

Annual Contract Payments

Most Service-based businesses have embraced the transition from project-based sales to Managed Services. However, some are still using a project concentric billing practice. Their contracts offer an annual service commitment, but services rendered are invoiced monthly.

Extra Tip 4: When customers lease, their leasing company is very open to including a 2–3-year service agreement in the lease. They like it because it increases the lease amount, and you will like it because they pay 3 years upfront. For example, an annual Service Agreement of $750,000 was paid to the vendor in a 3-year lump sum. The vendor effectively received a $2,250,000 interest-free loan.

Manage Cash or Line of Credit?

“Some manage cash flow and others manage line of credit.”

“Some manage cash flow and others manage line of credit.”

To use a fire metaphor: managing a line of credit is like keeping the fire under control; Managing Cash Flow is installing smoke detectors, and monitoring alarms to prevent fires from occurring.

CEOs and CFOs are acutely aware of one KPI, “how far into the line of credit are we this period”. Most often the issue comes up when the company needs to “meet payroll” or when a supplier’s big payment is due. The fire trucks come out to cover cash needs for that week and everyone moves on to other priorities, at least until the next fire. Meanwhile, the ashes are still glowing ready to spring up again.

Concluding Ideas

Cash Flow is a continuum of transactions that leads to plus or minus cash. It’s influenced by many components: forecast, margin, invoice, and the credit not yet consumed. With so many moving parts it’s hard to track or consolidate. That is why it can be a struggle.

You don’t fix any one thing, you fix the “flow of things” hence the value in a continuous system like Promys. Don’t try to improve everything at once. Start with just one area. Set a quantitative, small goal (e.g., 5% deposits within 3 months), learn what works, and expand the goal for the next 3 months),

Make Cash Flow a companywide project. If you report performance results (e.g., quarterly sales) to employees, why not add “Days-Aged” or “Deposits”. With everyone in the company pulling in the same direction, CEO and CFO’s stress levels go down. Now that’s one goal worth achieving!

Make Cash Flow a companywide project. If you report performance results (e.g., quarterly sales) to employees, why not add “Days-Aged” or “Deposits”. With everyone in the company pulling in the same direction, CEO and CFO’s stress levels go down. Now that’s one goal worth achieving!

When do you upgrade your systems? Doing it sooner is less risky than doing it too late. Reducing the number of independent systems makes a big difference. Start by making a list of ideal KPIs in advance of replacing your systems, this will help in the selection of any new system(s). While no single system is perfect, getting a comprehensive system that covers most aspects of the business will have a noticeable impact on the bottom line.

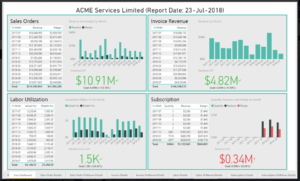

Promys’ business software solution seamlessly ensures that service-based businesses keep pace with growth while optimizing cash flow.